Charles Calomiris and Stephen Haber are professors in social sciences, specializing in the history of the banking system. In 2014, they published fragile on purpose, a book in which they explain the role of the banking system in state financing, the signaling of investment and access to loans at improved rate by special interest groups

The game of banking

The game of banking is intrinsically too risky for credit to develop significantly without property rights. It is only through the creation of banking charters and monopolies by the State that banks develop and can finance the modern state. The Bank of England is the best example.

The bank needs a legal system and property rights so as not to be looted by its creditors, by the State, or by its management.

The banking system evolves according to the structure of power:

Strong autocratic, the risk of confiscation by the state is strong, and the ruling elite serves special interests close to power. Minority shareholders and depositors do not want to bring capital, because financial repression is strong, and the risk is not remunerated. We think of many underdeveloped countries.

Low autocratic systems or oligarchic or the State does not have much power, inflation is used to finance public expenditure, while oligarchic scraps organize a confiscation of which they keep the benefit. We think of countries where inflation is endemic.

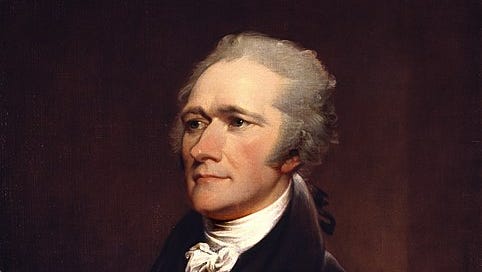

Liberal democratic systems, which have numerous checks and balances and a legal system that protects personal property rights. The banking system develops the most, even if this protection favors special interests that show oligarchic tendencies. We think of the bank proposed by Alexander Hamilton.

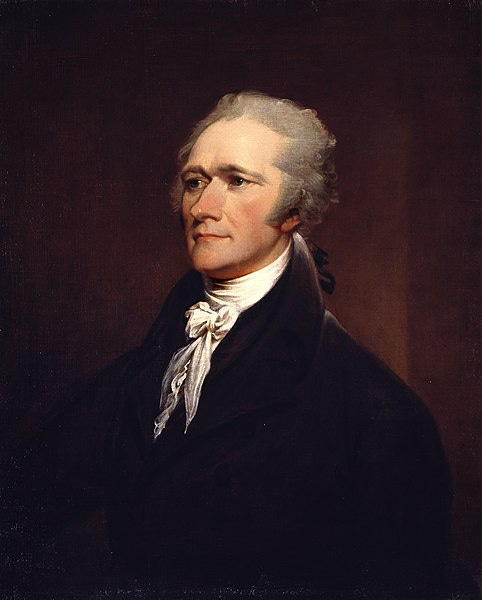

Populist democratic systems, in which a prince is chosen by popular acclaim, with the promise of redistributing wealth to the public. We think of the banking system proposed by Andrew Jackson, the guarantees of the State on real estate loans and no-recourse mortgages.

An alternative to the capitalist populist system is a collectivist system or loans to students, housing are no longer necessary because the State takes control of these sectors, which is the case in Europe.

Bank and State

A banking charter is necessary in the modern state. Costa Rica has no army, but it has a banking charter. Kuwait does not take any tax, but has a banking charter. Somalia had no more chartered banks between 1990 and 2011, but the state collapsed.

As Tilly notes, “the state made war and war made the state” in Europe between 1100 and 1500. From 1600, Calomaris and Haber contend that “the State made the banks and the banks made the State”.

The charter of the Bank of England, which grants a monopoly, aims to extract the funding necessary for wars against France from 1688 to 1815. The return to the gold standard will take 10 years after that. Several reforms from 1825 to 1860 will then allow the private banking system to develop in England. The Bank of England was fighting deregulation with an accommodating credit policy that caused 10 crises in those 35 years. In the end, the English banking system only reached its peak with the second globalization under Margaret Thatcher, while the American banking system was still too small.

Scotland of the 18th century gives the example of the most laissez-faire commercial banks, but this model of efficiency was rarely followed.

The state regulates who has the right to open a bank, and to whom it can grant credit, and on which terms. The state can also declare that the debt it issues is riskless and force the unpaid deposit of reserve at the central bank.

To decide who obtains the credits and at what prices is a way of distributing resources that is less obvious than redistribution by tax. Furthermore, there is considerable discretion for the regulator to decide during a crisis who must bear any extraordinary loss.

Countries do not choose by their banking system, they have the banking system that corresponds to their political regime.

Some facts about Banking

Credit is correlated with economic development. Since the 1990s, economists have established that causality has been from credit to development.

The size of the banking sector increases with the income level, there are however strong disparities linked to unfit institutions in certain countries.

The authors identify systemic banking crises (more than the bankruptcy of a few banks). By excluding the ex-communist countries and countries with less than 250 thousand inhabitants, they observe:

Frequent crisis and very little credit: Chad and Congo

Frequent crisis and little credit: Argentina, Bolivia, Brazil, Cameroon, Car, Colombia, Costa Rica, Ecuador, Kenya, Mexico, Nigeria, Philippines, Turkey, Uruguay. (Only Bolivia and Costa Rica have had stable democratic regimes since 1970)

There seems to be a link between authoritarian regimes and a poorly developed banking system.

The 6 developed countries that have not had a crisis: Australia, Canada, New Zealand, Malta, Hong Kong, Singapore. These countries have a rule of law strongly guaranteed by the Common Law. Institutions give rise to more for-lawyer than American populist democracy.

Developed countries that have had more than one recent crisis are Spain, Sweden, and the United States.

The United States and Canada

The banking system is developing around the cities in the northeast: Boston, New York, Baltimore from the Independence wars to 1820. From then on, the rural United States dominated politically. The transition happens through the introduction of universal suffrage, between the stolen election by Adams and Clay in 1824 from the populist Andrew Jackson, and the election of the latter in 1828.

The BNA (Bank of North America) then the BUS (Bank of the United States) have a federal charter. The latter will not be renewed in 1811, and the second BUS charter was not renewed in 1834. From then on, the banks are chartered within a state, most cannot have branches. This prevents any diversification of risk and any economy of scale. Farmers accept this inefficiency as the price of sustained access to credit: the bank does not cut the financing of producers of corn or soy when all large customers in that city are large farmers.

Unlike the populist United States since 1824, the British crown, in the 18th century, has to face a majority French-speaking Catholic population in Canada. Other regions are created in order to dilute the power of Quebec. The Senate which controls financial regulations is appointed by the sovereign. Canada is therefore a liberal democracy (which means for the author that the power of the majority faces many checks and balances), which prevents irrational choices concerning the banks.

As a result, Canadian banks have not had a crisis for three centuries while the American system has experienced 17 crises. Following the 1907 crisis, the American national finance committee of 1910 published three books on the Canadian system and how it avoids crises. However, the decision after the 1910 commissions will not be to rationalize the US system because congressmen would not allow it, but to create the Federal Reserve.

Urban America regains political dominance in the 20ᵉ century. Regulatory changes are necessary to deal with the second globalization after 1980. These reforms do not polarize across partisan lines between Democratic/Republican, but across urban/rural constituencies. Democrats promote cities and banking consolidation. Republican presidents must also promote it to win the Florida and Ohio elections.

The American banking system is centered around North Carolina because its state banks had the right to open branches and consolidate. The 1980 Savings and Loans crises allow these bankers to suggest to FDIC and regulators to allow these consolidated operations to bailout small banks in other states.

The consolidation of American banks happened between 1980 and 1992. From 1992 to 1997, local lobbies were invited to offer more deregulation to the Fed, while banks promise these groups to lend 900 billion. From 1990 to 2007, Congress joined forces with these groups to enable access to credit. Congress mandated the sponsored agencies Fannie Mae and Freddie Mac to lower the quality requirements for the repurchase of mortgage. This allows banks to extend credit far beyond what is financially responsible.

We come to the conclusion that the banking system is badly managed in the United States, that this is well known since the 19th century, but that the Congress prefers a suboptimal and fragile setup.

Conclusion

This research work on the banking system wants to learn lessons from the great financial crisis of 2007. The authors make a distinction between autocracy and democracy, then between liberal democracy, meaning that there is a rule of law checking the tyranny of the majority, and populist democracy, which according to them took power in the United States between 1810-1828.

In populist regime, crises are caused by bargains between populist politicians and bankers. The 2007 crisis is the consequence of the law signed by G Bush SR in 1992 shortly before the election to relax mortgage underwriting standards by imposing on the agencies to assume these mortgage, that they could securitize and even resell to banks with an AAA credit.